What exactly is your credit score and why should you care about monitoring your credit anyway? What can you do (or not do) to help improve your credit score? If you are asking yourself these questions then you are in the right place. In this article we are going to discuss the basics myths about credit scores and the numerous myths you may have heard surrounding your credit score. Why? Because having good credit will save you money and that is what we are all about. Let’s get started:

Credit Score – The Basics

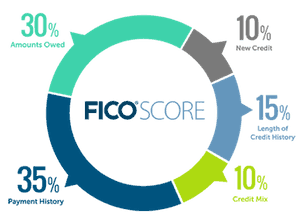

To put as simple as possible your credit score is calculated based on a number of different financial factors to include:

- Your Payment History

- How Much You Owe (Total Debts)

- Length of Your Credit History

- New Credit You Have Applied for or Obtained

- Other Factors (these may vary from one financial institution to another)

These factors are assigned weight and are calculated in order to assess the financial risk that an applicant possesses. The result is a credit score that is taken into consideration when choosing to approve or deny a loan request or loan terms (interest rates).

Credit scores traditionally range from 300 (poor) to 850 (excellent) and the current U.S. average score is 687 although this varies from state-to-state.

A ‘good’ credit score is very subjective and it is not uncommon to be denied by one financial institution and approved by another. Ultimately it is up to the institution to decide what kind of risk an applicant possess and their comfort level with loaning money to a particular applicant. A credit score is just one factor that they consider in the process.

Credit Score – The Myths vs. Reality

Bad People Have Bad Credit Scores

Your credit score only measures your risk based on your history and current obligations. It makes no indication that you are a ‘bad’ or ‘good’ person and should not speak to one’s moral character. There are a number of life factors that can contribute to a poor credit score such as a failed business, divorce, loss of a job or an unexpected death in the family.

Having a Good Job = Good Credit Score

Credit scores do NOT take into account your salary or current job title. In fact, they don’t even take into consideration that you have a job or salary at all. This is one of the primary reasons why your credit score is only one of the many factors taken into consideration when you apply for a loan.

Having a Low Credit Score Means You Will Never Get Approved for a Loan

This is not necessarily true. Remember that your score is only one factor taken into account when a bank reviews a loan request. Now, poor credit will definitely make getting approved more difficult and will certainly have an effect on your offered interest rate which will result in a higher monthly payment. Finding a quality co-signer may help you get approved without a significant bump in your interest rate.

Having Money in the Bank will Raise Your Credit Score

The amount of money you have in the bank (or under your mattress) has no effect on your credit score. Other factors not taken into consideration include your age, race, gender or sexual orientation none of which are reported to the major credit bureaus.

Checking Your Credit Will Lower It

Checking your credit score for your own benefit results in a ‘soft inquiry’ and will not affect your score. In fact it may be looked at as a positive sign that you care about your score and are monitoring it accordingly. However, when your credit score is pulled as a result of a credit application then it is considered a ‘hard inquiry’ and it can have a negative effect on your credit score. This is one major reason you should not apply for credit unless you need it.

Credit Info is Always Accurate

This is far from the case. This is one of the primary reasons you should periodically thoroughly check your full credit report (not just your score) at least once per year. You should also check it before applying for any large purchase such as a mortgage to ensure the info contained within is accurate. Any inaccurate info can be disputed and eventually removed but the process takes time and is outlined HERE.

You Only Have One Credit Score

There are three major credit bureaus (Experian, Trans Union and Equifax) and each one uses a slightly different formula to calculate your credit score. Most lenders will utilize one of these services when making a decision on credit approval.

You Have a Joint Credit Score if Married

Your credit score is linked to your individual social security number. This means that any joint loans (such as a mortgage) will appear on both you and your spouse’s reports.

Your Credit Scores Are Only Updated Once Per Year

Your credit score can change as soon as new credit info (good or bad) is received by the credit bureaus. This may result in monthly or even weekly changes to your credit score depending upon your recent activity.

Not Using Your Credit is a Good Thing

It may sound a bit contradictory, but you need to utilize your credit to show you are responsible. Now, don’t run out and max out those credit cards. You should just periodically use your credit cards will help build up your payment history and will boost your overall score.

Closing Unused Credit Accounts Will Boost Your Score

Closing an unused credit account actually lowers your credit utilization ratio and can hurt your credit score. Nothing wrong with keeping unused accounts ‘on the books’ just make sure you use them periodically to build up a payment history. Also, if you feel like you need to close an account choose the newest account you have. Older accounts have more of a payment history and are more valuable for credit score purposes.

Credit Scores are Good vs. Bad

Credit score simply provide financial data in regards to your current debts, collections history and current credit use. These scores are then used by lenders to determine what risks are present for a potential customer. A score is only one of the factors considered and should not be viewed as ‘good’ vs. ‘bad’.

Missed Payments Fall Off Your Report Quickly

Negative information (to include missed payments) on your credit report remain there for as long as 7 years (sometimes even 10 for bankruptcies). This is why it is very important to pay your bills timely in order to build up a positive history.

Pre-Paid Credit / Debit Cards Will Boost Your Score

This used to be a popular tactic for people to try to build credit when they did not have any. The fact is that these types of unsecured credit accounts are not reported to the credit bureaus and therefore have no effect (good or bad) on your credit score.

Ignorance is Bliss

Don’t know your credit score? Haven’t checked it in a few years? Don’t wait until you are applying for a mortgage or car loan to look at your credit score and report. Checking it has gotten much easier and you should be able to do it for free. Several credit card companies (Discover for example) put your current credit score on the bottom of every monthly statement. See a dip in your score? Head over to freecreditreport.com and see what is going on.

Employers Can Use Credit Against You

The laws surrounding this issue vary from state-to-state but certain professions (law enforcement, legal, medical, banking) may request a copy of your credit report during the application process. While this may feel like an invasion of your privacy it only makes sense when you consider that certain professions have a higher potential for bribery and/or theft.

Having No Credit or Debt is a Good Thing

We all have to start somewhere and many young adults learn quickly that having no credit history may require them to find a co-signer in order to qualify for a loan. This is one reason why it is important to establish credit as early as you can in order to build a history that will help you in the future. Also, many lenders (Honda for example) offer approved financing for recent college graduates to help them get established credit.

Debt Consolidation Will Improve Your Credit Score

When looking into services such as debt consolidation be very careful to thoroughly research any company through the Better Business Bureau (BBB) first. Some companies use questionable tactics that in the end may actually further damage your credit and cost you even more money.

Subscribe to our newsletter for more money-saving wisdom and check back regularly for new coupons. Happy saving!

Take a Deep Breath and Save

Did you know that Amazon now has coupons for hundreds of items – see what savings they have available HERE.

Looking for more coupons? Online coupons, All Deals, Amazon Deals and click HERE to see a list of our coupon resources.